Governance & Responsibilities

Board Charter

INTRODUCTION

The Board of Directors of Ajiya Berhad (“Ajiya” or the “Company”) is collectively responsible for the sustainable performance of the Company and its subsidiaries (“the Group”). The Board is also ultimately responsible for the corporate governance and management of the Group.

This Board Charter incorporates the requirements of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad (“MMLR”), the Companies Act 2016, the Malaysian Code on Corporate Governance (“MCCG” or the “Code”) and the Constitution. To the extent of any conflict between the terms of the Board Charter and the relevant statutory regulations, the provision of statutory regulations prevail.

OBJECTIVES

This Charter set out the key roles and responsibilities of the Board. It is a source of reference and primary induction document to assist the Board in discharging their fiduciary duties as Directors of the Company.

THE BOARD

3.2 Composition

3.2.1 Size and Mix of Skills

3.2.2 Independence

3.2.3 Diversity

3.3 Re-election

3.4 New Appointment

3.5 Director’s Fit and Proper Requirements

- Character and Integrity;

- Experience and Competence; and

- Time and Commitment.

3.6 Duties and Responsibilities

3.6.1 Board Roles

- Review, adopt and monitor the overall corporate strategy, direction and budget of the Group; and ensure that the strategic plans supports long term value creation;

- together with the Management, take responsibility on sustainability governance including setting the Group’s sustainability strategies, priorities and targets;

- promoting, together with senior management, a sound corporate governance culture within the Group which reinforces ethical, prudent and professional behavior;

- oversee and evaluate the conduct of business of the Group which includes supervision and assessment of Management’s performance to determine whether the business is properly being managed;

- understand the principal risks of the Group, set the risk appetite within which Management is expected to operate and ensure there is an appropriate risk management framework to identify, analyse, manage and monitor these risks;

- review the adequacy and integrity of the financial and non-financial reporting of the Group.

- approve the appointment, succession plans and remuneration of the Directors.

- ensure the key senior management has the necessary skills and experience, and there are measures in place to provide for the orderly succession of key senior management;

- develop and implement investor relation and shareholders communication policy; and

- ensure there is a sound framework for internal control and risk management system which enable risks to be assessed and managed.

- Approve the appointment of external auditors.

- material acquisition and disposition of assets not in the Group’s ordinary course of business;

- approval of corporate plans and new ventures of the Group

- approval of changes of major activities of the Group

- approval of board policy and procedures

- declaration of dividends

- approval of financial statements and quarterly results

- appointment of Directors and Board Committees members

- any matters as may be required by the applicable laws and regulations

3.6.2 Role of Chairman

- provides leadership for the Board and ensure the Board perform its responsibilities effectively;

- ensures the Board play constructive part in determination of the Group’s strategy direction and the decision fairly reflect the Board’s consensus;

- ensures effective functioning and smooth conduct of Board meetings;

- leading the Board in establishing and monitoring good corporate governance practices in the Company;

- promotes constructive and respectful relations between Directors, and between the Board and Management;

- encourages active participation of Board members and allowing dissenting views to be freely expressed;

- plans and ensures the agenda of Board meetings contain all relevant issues, together with the Managing Director/Executive Directors and Company Secretaries;

- chairing meetings of Members and acts as representative of the Board to shareholders, together with the Managing Director/Executive Directors;

- Ensure General Meetings support meaningful engagement between Board, senior managements and shareholders;

- promotes effective communication with stakeholders and that their views are communicated to the Board.

3.6.3 Role of Managing Director / Executive Director

- develop corporate strategies of the Group and to implement such corporate strategies as approved by the Board;

- ensure the Group’s vision and mission, profitability and return on capital are achieved;

- effectively oversee the human resources and succession planning of the Group;

- provide direction for the implementation of business plans in a cost effective manner;

- ensure business operations are conducted in compliance with the relevant laws and regulations;

- exploring business opportunities which are of potential benefit to the Group;

- ensure financial management is performed at highest level of integrity and that the business affairs are conducted in an ethical manner;

- acting as the primary spokesperson for the Group and communicate with investors and stakeholders in an orderly manner and shall be mindful of the regulatory requirements governing the release of material and price sensitive information.

3.6.4 Role of Independent Directors

- provide independent judgement, experience and objectivity without subordinated to operational considerations;

- ensure the interests of all shareholders are taken into account by the Board and that the relevant issues are subjected to objective and impartial consideration by the Board.

- constructively challenge and contribute to the development of the business strategies and direction of the Group;

- ensure there are adequate systems, controls and check and balance to safeguard the interests of the Group and all stakeholders.

3.7 Board Meetings

3.7.1 Frequency of Meetings and Attendance

3.7.15Board meetings could be conducted physically and/or via electronic means where the Directors may receive agenda and meeting papers online or in digital format and participate in meetings via audio or video conferencing.

3.7.2 Meeting Agenda and Board Papers

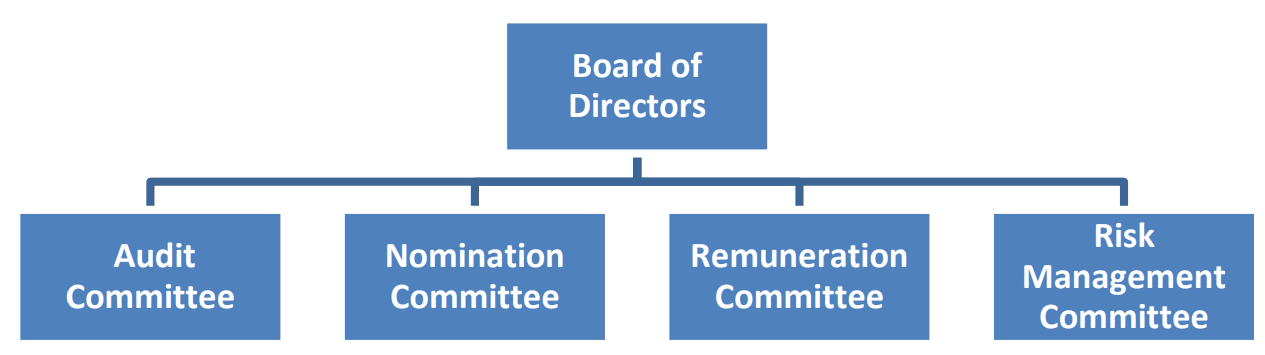

3.8 Board Committees

Audit Committee assists in providing oversight on the Group’s financial reporting, disclosure, regulatory compliance and monitoring of internal control processes and risk management within the Group. The Audit Committee reviews the quarterly financial results, unaudited and audited financial statements, related party transactions, conflict of interest situations and the independence of internal and external auditors.

The Nomination Committee oversees matters relating to the appointment of new Director, re-election and re-appointment of Directors. The Nomination Committee is also responsible to review the Board composition and effectiveness of the Board, its Committees, individual Director, individual Committee members as well as succession planning of key senior management.

The Remuneration Committee review and implement policy and procedures governing the remuneration for Directors and Key Senior Management.

The Risk Management Committee is responsible to identify, recommend and review the principles, framework and process for managing risk within the Group.

3.9 Directors’ Induction Plan, Training and Continuing Education

- Board Charter

- Meeting Timetable

- Minutes of the last Board Meeting

- Latest Annual Report

- Minutes of last Board Committee Meeting, if the new Director is also a member of the Board Committee, where relevant.

3.10 Board and Board Committees Evaluation

3.11 Directors Remuneration

ACCOUNTABILITY AND AUDIT

4.1 Financial Reporting

4.2 External Auditors

4.3 Internal Controls and Risk Management

INVESTOR RELATIONS AND SHAREHOLDERS COMMUNICATION

5.1 Communication with Shareholders and Investors

5.1.1 The Board shall maintain an effective communication with its shareholders, investors, analysts and the public.

5.1.2 The Board ensures timely release of announcement to the Bursa Malaysia Securities Berhad, which includes quarterly financial results, annual reports and circulars to provide shareholders with an overview of the Company performance and operation and any other material information that may affect investors’ decision making.

- regular dialogues with financial analysts;

- press interview, where necessary, to provide the media an opportunity to receive an update from the Board on the Company’s performance and to address any queries or areas of interest of the media;

- the Company’s website provides easy access to corporate information pertaining to the Company and its activities and is continuously updated.

5.2 General Meetings

5.2.1 The Company regards the General Meetings as an important event for dialogue with shareholders where the Directors are present in person to engage directly with the shareholders.

- ensure that each special business in the notice of meeting to be accompanied by a statement regarding the effects of the proposed resolution.

- conduct a business presentation with question and answer session, where appropriate and if required.

- the engagement with shareholders should be interactive and include robust discussion on among others the Group’s financial and non-financial performance as well as the Group’s long-term strategies.

- shareholders should also be provided with sufficient opportunity to pose questions during the meeting and all questions should receive a meaningful response.

- ensure minutes of the General Meetings are circulated to shareholders or uploaded onto the Company’s website no later than 30 business days after the General Meetings.

COMPANY SECRETARY

6.1 The Company Secretary plays an important advisory role and is a source of information and advice to the Board and Committees on issues relating to corporate governance best practices, corporate disclosure obligations, Board policies and procedures and compliance with statutory and regulatory requirements.

- advises the Board on corporate governance issues;

- advises the Board on disclosure and compliance with securities regulations and listing requirements;

- attends Board, Committees and general meetings, and ensure the proper recording of minutes;

- ensures proper upkeep of statutory registers and records;

- facilitates the induction training of new Directors.

6.3 All Directors shall have full access to the advice and services of the Company Secretary.

ACCESS TO INFORMATION AND INDEPENDENT ADVICE

7.1 The Directors have the right to access to all information pertaining to the Group’s business affairs in the discharge of their duties.

7.2 The Board as well as any Director may seek independent professional advice relating to the affairs of the Group or his/her responsibilities as a Director, at the Company’s expense. If a Director considers such advice is necessary for the benefit of the Company, such Director shall first discuss with the Chairman. The Director must also ensure that it is practicable and the cost is reasonable.

DIRECTORSHIP AND DISCLOSURE OF INTEREST

8.1 Directors should devote sufficient time to carry out their responsibilities. A Director shall not hold more than five (5) directorships in listed corporations, as prescribed by the MMLR.

8.2 Directors should notify the Chairman or the Company Secretary their directorship in other listed and non-listed companies and any changes thereof.

8.3 The Companies Act 2016 provided that a Director or person connected with a Director (such as family members, or a body corporate associated with the Director or trustee), who is in any way, whether directly or indirectly, interested in a contract or proposed contract with the Company and or its subsidiaries shall, as soon as practical after the relevant facts have come to the knowledge of the Director, declare the nature of his interest to the Board.

8.4 The Director concerned shall be counted only to make the quorum at the meeting of the Board but shall not participate in any discussion and shall not vote on the contract or proposed contract.

DEALING IN SECURITIES

9.1 Directors are required to comply with the procedures and requirements of the MMLR when dealing in the securities of the Company.

9.2 A Director is required to notify the Company Secretary his shareholding in the Company and any changes thereof, whether direct or indirect.

ETHICS AND INTEGRITY

10.1 All Board members are expected to act in a professional manner and upholding the core values of integrity with due regard to their fiduciary duty and responsibilities at all times in their actions.

- Code of Ethics and Conduct

The Code of Ethics and Conduct provides guidance for proper standards of ethical conduct and sound and prudent business practices for Directors and employees based on principles of integrity, responsibility, trust, discipline and diligence.

- Stay Honest, Be Corrupt Free

The Anti-Bribery and Anti-Corruption Policy sets out the principles of Ajiya in upholding its position on bribery and corruption practices in relation to its business. It also provides guidance to prevent and address improper solicitation, bribery and corruption activities.

- Whistleblower Policy

The Whistleblower Policy govern the reporting and handling of suspected and/or known misconducts, wrongdoing, corruption and instances of fraud and abuse involving the resources of the Group.

10.3 The Code of Ethics and Conduct, Anti-Bribery and Anti-Corruption Policy as well as Whistleblower Policy are available for reference on the Company’s website at www.ajiya.com.

REVIEW OF THE BOARD CHARTER

11.1 The Board Charter is approved and adopted by the Board.

11.2 The Board Charter will be periodically reviewed and updated in accordance with the needs of the Company and any new regulations issued by the relevant authorities.

11.3 The Board Charter is made available for reference on the Company’s website at www.ajiya.com.